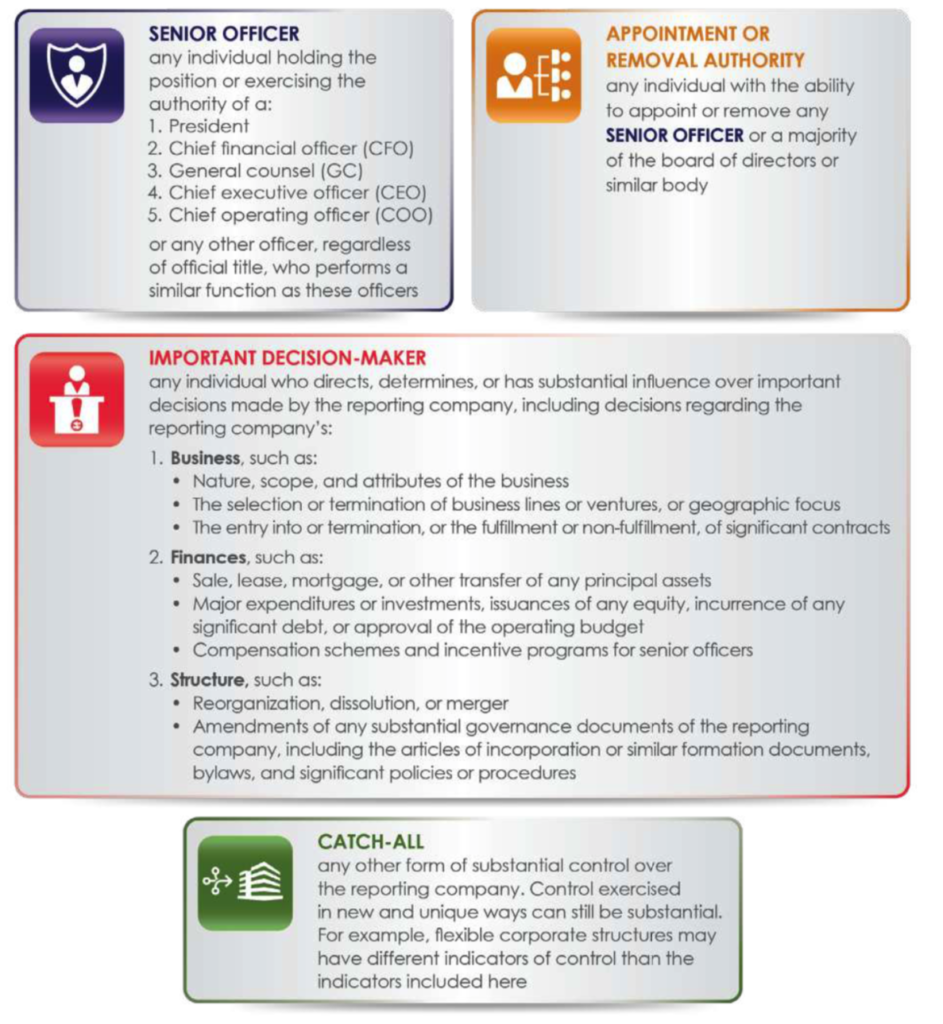

Any individual with substantial control is a beneficial owner, even if they hold no ownership of the reporting company.

Unlike other definitions of Beneficial Ownership, FinCEN includes those with only substantial control as beneficial owners. This means that a hired manager, with no equity, can be a beneficial owner if they can make decisions for the company.

Reporting companies must identify all individuals who have substantial control over the company. Substantial control is defined by meeting one or more of the following criteria:

This definition is all-encompassing and designed to catch all possible individuals with control. Companies should never seek to structure themselves in a way to avoid reporting an individual with control.

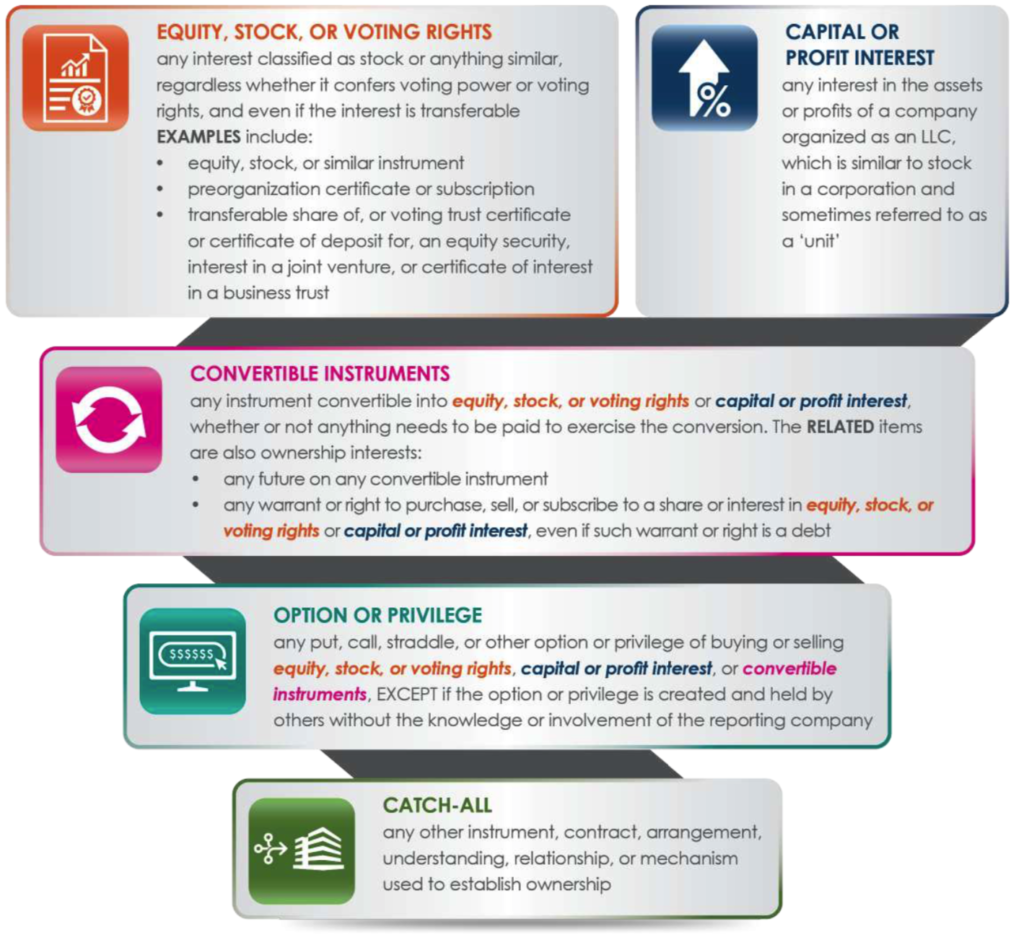

Any individual with 25% or more ownership of the reporting company is a beneficial owner and must be listed on the report. Types of ownership include equity, shares, or voting rights; interests in profits or capital; instruments convertible into ownership; options or similar rights to purchase or sell ownership instruments.

Example 1: An LLC is owned by three members, each with 1/3 of the entity. Every owner is a beneficial owner for having 33.3% ownership.

Example 2: An LLC is owned by five members, each with 1/5th ownership. The members hired a manager to run the business. Only the manager is a beneficial owner because every member owns 20%, which is less than 25%.

Example 3: A corporation has issued 70% of its shares to Robert as an investor, and Susan is the CEO with only 10% of the shares. Both are owners because Robert owns over 25% and Susan has substantial control as CEO.

Example 4: A corporation has issued 20% of its shares to Share Holdings LLC, which is 50% owned by Robert. Robert also owns 15% of the corporation directly outside of his LLC. Robert is a beneficial owner because he owns 1/2 of the entity with 20% ownership of the corporation plus 15% ownership directly. This totals 25%, placing Robert at the beneficial ownership threshold.

Example 5: An investor holds a convertible note for a corporation. This note can convert to 50% equity at a later date. The investor is a beneficial owner.

Step 1: Determine who has significant influence over the company’s decisions.

Step 2: Compute the ownership percentages held by individuals to pinpoint those with at least a 25 percent stake in the company, either directly or indirectly through entities such as LLCs.

Reporting depends on the number of beneficial owners on your list. Simple entities with less than ten beneficial owners can typically file by themselves online. More complicated entities with over ten beneficial owners should consider finding a specialize law or accounting firm to navigate this regulation.

You can find more help by selecting a card below.

We recommend companies with simple ownership structures take their list of owners to an online filing platform to complete their reports. TurboCTA.com is an affordable solution for business owners.